Help stop wrongful home foreclosure HECM

Donation protected

Here’s a post about my letter to Chief Justice John Roberts

No response from Chief Justice John Roberts; corrupted Supreme Court Petitions No. 12-7747 and No. 13-7280

The Honorable John G. Roberts, Jr

Chief Justice of the United States

Supreme Court of the United States

One First Street N.E.

Washington, D.C. 20543

RE: Petition No. 13-7280, documents do not appear on the Court’s computer system. Referral by Senator Rubio’s office to the CFPB; intervening circumstances of a substantial or controlling effect and other substantial grounds not previously presented.

Dear Mr. Chief Justice:

Currently my pro se, nonlawyer IFP petition for rehearing an order denying Petition No. 13-7280 is pending before the Court, and was distributed February 19, 2014 for Conference of March 7, 2014. I am concerned that documents in this matter do not appear on the Court’s computer system. This happened in a previous petition too, Petition No. 12-7747.

A letter I received February 4, 2014 from Assistant Clerk Michael Broadus returned voluminous exhibits in Petition No. 13-7280 before time expired to file a petition for rehearing. So I called the Court to find out why, since the Court might want to see the exhibits on rehearing.

The woman who took my call could not find the letter of Mr. Broadus in the Court’s computer system. Similar problems happened in Petition No. 12-7747 too, documents were lost or missing.

Do you know why documents in my petitions do not appear on the Court’s computer system? Last year I contacted Kathleen Arberg, Public Information Officer, but did not get a response. more here

__________________________________________________

Hello, this is a long-overdue update on the wrongful mortgage foreclosure of my home. The US Supreme Court denied my Petition No. 13-7280 and rehearing, shown on the docket.

On July 25, 2014 I filed Defendants’ Rule 1.150 Motion To Strike Sham Pleadings in my state court foreclosure. This motion was filed as a placeholder or caveat, and only set for hearing prior to the Plaintiff scheduling any hearings, and pending exhaustion of federal judicial review, federal administrative review, investigative law enforcement agency inquiry, and The Florida Bar inquiry of Plaintiff’s counsel Ms. Parsons.

A couple days later Florida Bar Counsel Patricia Ann Toro Savitz’s letter of July 29, 2014 referred my complaint against McCalla Raymer lawyer Danielle Nicole Parsons to Lisa M. Acharekar, Chair of the Ninth Circuit Grievance Committee "A".

____________________________________________________

Hello, I am asking for support to save my home from wrongful foreclosure on a HECM reverse mortgage. I am not a lawyer, just an ordinary person representing myself pro se. Opposing counsel is foreclosure mill McCalla Raymer LLC, representing Reverse Mortgage Solutions, Inc.

Defending foreclosure is costly in the Supreme Court, even when appearing in forma pauperis.My UPS invoices total $1,891.22

for the last three months.

On January 3, 2014 I paid $514.62 in UPS shipping charges

On December 3, 2013 I paid $833.19 in UPS shipping charges

On November 1, 2013 I paid 543.41 in UPS shipping charges

Any amount donation is appreciated; excess amounts will go toward ongoing expenses, such as, a case of paper ($29), copy machine toner ($50), a replacement drum ($41), inkjet printer cartridges ($38 a pair), a process server ($25) or $50 expedited, or computer repairs ($60 hr.).

Neil J. Gillespie v. Reverse Mortgage Solutions, Inc. et al

Petition No. 13-7280 for rehearing, U.S. Supreme Court

My petition was denied January 13, 2014. Rule 44 allows a petition for rehearing within 25 days, which I believe is February 7, 2014. If my petition for rehearing is denied, the district court suggested in its remand order that I may sue the U.S. Department of Housing and Urban Development (HUD) in a separate action.

"This Order should not be interpreted as a ruling concerning whether, or to what extent, Mr. Gillespie can sue HUD in a separate action. Rather, this Order is limited to whether the Court has subject matter jurisdiction over the specific action that has been removed to this Court". - Senior U.S. Judge Wm. Terrell Hodges, Order Remanding Case, March 7, 2013.

STATEMENT OF THE CASE, from my Petition No. 13-7280

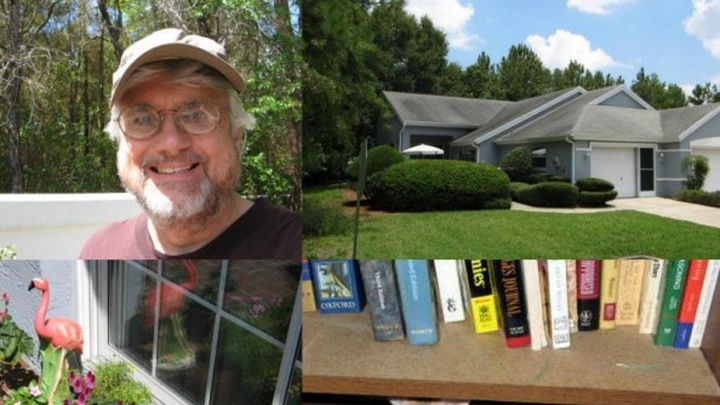

My name is Neil Gillespie, the petitioner reluctantly appearing pro se [fn1], henceforth in the first person, age 57, a law-abiding, indigent, disabled single man, a surviving "reverse" mortgage borrower [fn2], and homeowner in a 55+ community in Ocala Florida. This petition is to save my home from a disputed foreclosure [fn3] of a Home Equity Conversion Mortgage [fn4] or HECM, a FHA [fn5] "reverse" mortgage program administered by the Secretary, United States Department of Housing and Urban Development (Secretary or HUD). My home's value is $74,730 and falling. The mortgage payoff balance is $114,889. The property is "underwater" by $40,159. A HECM cannot be refinanced.

A ruling January 4, 2013 in Bennett v. Donovan held in part:

"HUD itself has the capability to provide complete relief to the lenders and mortgagors alike, which eliminates the uncertainty of third-party action that would otherwise block standing."

I bear witness to the "uncertainty of third-party action", which is described further on my justice network blog.

A HECM does not require a homeowner to make mortgage payments as a conventional mortgage does. Instead, a HECM does not become due and payable until the last surviving homeowner dies or no longer lives in the home. 12 U.S.C. § 1715-z20(j) Safeguard to prevent displacement of homeowner. The HECM becomes due and payable in full "if a mortgagor dies and the property is not the principal residence of at least one surviving mortgagor....and no other mortgagor retains title to the property." 24 C.F.R. § 206.27(c).

I am one of two surviving HECM mortgagors, and the only surviving homeowner living in the home, alone, in substantial compliance with the HECM Note, making this foreclosure of a HECM premature. My bother Mark Gillespie of Fort Worth Texas is also a surviving borrower, but he does not live in the home. The HECM becomes due and payable in full "if a mortgagor dies and the property is not the principal residence of at least one surviving mortgagor....and no other mortgagor retains title to the property." 24 C.F.R. § 206.27(c). Mortgagor Ms. Gillespie died in 2009.

But I am a surviving borrower or mortgagor living in the home as my principal residence, and retain title to the property. Therefore I dispute the Plaintiff's allegations in its "Verified Complaint to Foreclose Home Equity Conversion Mortgage". (Doc. 2). That means a substantial disputed issue of federal HECM law is a necessary element of the Plaintiff's state law foreclosure claim that this HECM is due and payable.

The district court has subject matter jurisdiction under 28 U.S.C. § 1331 and the U.S. Constitution, Article III, Section 2 for "all cases, in law and equity, arising under this Constitution, [and] the laws of the United States...". (Doc. 18, page 2). Fed. R. Civ. Pro 13(g) permits a crossclaim by one party, me, against a coparty, HUD, "if the claim arises out of the transaction or occurrence that is the subject matter of the original action or of a counterclaim, or if the claim relates to any property that is the subject matter of the original action." My home is property that is the subject matter of the original action. The Plaintiff's Complaint (Doc. 2) is an in rem action against my home (Doc. 1, 1, and 15) my primary residence (Doc. 5, 2, 6, 9, 20, 118, ) and homestead. (Doc. 9).

Also see my Motion to Reconsider, Vacate or Modify Order filed July 2, 2013 in the U.S. Eleventh Circuit Court of Appeals, No. 13-11585-B. Most of the pleadings are posted on Scribd, including my Notice of Removal, the foreclosure complaint, my motion to dismiss,and exhibits, with my complaint to the Consumer Financial Protection Bureau (CFPB), parts one, two and three.

Thank you for your support.

Neil J. Gillespie

8092 SW 115th Loop

Ocala, Florida 34481

[fn1] I was a client of Community Legal Services of Mid-Fla. which provides legal advice, but not foreclosure representation. I paid a $25 Florida Bar referral fee to Gregory D. Jones, Esq. but he has not responded to my disability accommodation request, or consulted with me on UPL.

[fn2] I am one of three (3) HECM borrowers, with brother Mark Gillespie, and mother Penelope Gillespie, whose death September 16, 2009 Plaintiff claims is grounds to accelerate the debt.

[fn3] Reverse Mortgage Solutions, Inc. v. Neil J. Gillespie, et al., Marion County Florida, Fifth Judicial Circuit, No. 42-2013CA-000115-AXXX-XX; removed February 4, 2013 to U.S. District Court, Ocala Division, Middle District Florida, No. 5:13-cv-00058-WTH-PRL; U.S. Court of Appeals for the Eleventh Circuit, No. 13-11585-B; real party Plaintiff, Bank of America, N.A.

[fn4] 12 U.S.C. § 1715z"“20 - Insurance of home equity conversion mortgages for elderly homeowners, and 24 C.F.R. Part 206, Home Equity Conversion Mortgage Insurance.

[fn5] The Federal Housing Administration (FHA) is a United States government agency.

No response from Chief Justice John Roberts; corrupted Supreme Court Petitions No. 12-7747 and No. 13-7280

The Honorable John G. Roberts, Jr

Chief Justice of the United States

Supreme Court of the United States

One First Street N.E.

Washington, D.C. 20543

RE: Petition No. 13-7280, documents do not appear on the Court’s computer system. Referral by Senator Rubio’s office to the CFPB; intervening circumstances of a substantial or controlling effect and other substantial grounds not previously presented.

Dear Mr. Chief Justice:

Currently my pro se, nonlawyer IFP petition for rehearing an order denying Petition No. 13-7280 is pending before the Court, and was distributed February 19, 2014 for Conference of March 7, 2014. I am concerned that documents in this matter do not appear on the Court’s computer system. This happened in a previous petition too, Petition No. 12-7747.

A letter I received February 4, 2014 from Assistant Clerk Michael Broadus returned voluminous exhibits in Petition No. 13-7280 before time expired to file a petition for rehearing. So I called the Court to find out why, since the Court might want to see the exhibits on rehearing.

The woman who took my call could not find the letter of Mr. Broadus in the Court’s computer system. Similar problems happened in Petition No. 12-7747 too, documents were lost or missing.

Do you know why documents in my petitions do not appear on the Court’s computer system? Last year I contacted Kathleen Arberg, Public Information Officer, but did not get a response. more here

__________________________________________________

Hello, this is a long-overdue update on the wrongful mortgage foreclosure of my home. The US Supreme Court denied my Petition No. 13-7280 and rehearing, shown on the docket.

On July 25, 2014 I filed Defendants’ Rule 1.150 Motion To Strike Sham Pleadings in my state court foreclosure. This motion was filed as a placeholder or caveat, and only set for hearing prior to the Plaintiff scheduling any hearings, and pending exhaustion of federal judicial review, federal administrative review, investigative law enforcement agency inquiry, and The Florida Bar inquiry of Plaintiff’s counsel Ms. Parsons.

A couple days later Florida Bar Counsel Patricia Ann Toro Savitz’s letter of July 29, 2014 referred my complaint against McCalla Raymer lawyer Danielle Nicole Parsons to Lisa M. Acharekar, Chair of the Ninth Circuit Grievance Committee "A".

____________________________________________________

Hello, I am asking for support to save my home from wrongful foreclosure on a HECM reverse mortgage. I am not a lawyer, just an ordinary person representing myself pro se. Opposing counsel is foreclosure mill McCalla Raymer LLC, representing Reverse Mortgage Solutions, Inc.

Defending foreclosure is costly in the Supreme Court, even when appearing in forma pauperis.My UPS invoices total $1,891.22

for the last three months.

On January 3, 2014 I paid $514.62 in UPS shipping charges

On December 3, 2013 I paid $833.19 in UPS shipping charges

On November 1, 2013 I paid 543.41 in UPS shipping charges

Any amount donation is appreciated; excess amounts will go toward ongoing expenses, such as, a case of paper ($29), copy machine toner ($50), a replacement drum ($41), inkjet printer cartridges ($38 a pair), a process server ($25) or $50 expedited, or computer repairs ($60 hr.).

Neil J. Gillespie v. Reverse Mortgage Solutions, Inc. et al

Petition No. 13-7280 for rehearing, U.S. Supreme Court

My petition was denied January 13, 2014. Rule 44 allows a petition for rehearing within 25 days, which I believe is February 7, 2014. If my petition for rehearing is denied, the district court suggested in its remand order that I may sue the U.S. Department of Housing and Urban Development (HUD) in a separate action.

"This Order should not be interpreted as a ruling concerning whether, or to what extent, Mr. Gillespie can sue HUD in a separate action. Rather, this Order is limited to whether the Court has subject matter jurisdiction over the specific action that has been removed to this Court". - Senior U.S. Judge Wm. Terrell Hodges, Order Remanding Case, March 7, 2013.

STATEMENT OF THE CASE, from my Petition No. 13-7280

My name is Neil Gillespie, the petitioner reluctantly appearing pro se [fn1], henceforth in the first person, age 57, a law-abiding, indigent, disabled single man, a surviving "reverse" mortgage borrower [fn2], and homeowner in a 55+ community in Ocala Florida. This petition is to save my home from a disputed foreclosure [fn3] of a Home Equity Conversion Mortgage [fn4] or HECM, a FHA [fn5] "reverse" mortgage program administered by the Secretary, United States Department of Housing and Urban Development (Secretary or HUD). My home's value is $74,730 and falling. The mortgage payoff balance is $114,889. The property is "underwater" by $40,159. A HECM cannot be refinanced.

A ruling January 4, 2013 in Bennett v. Donovan held in part:

"HUD itself has the capability to provide complete relief to the lenders and mortgagors alike, which eliminates the uncertainty of third-party action that would otherwise block standing."

I bear witness to the "uncertainty of third-party action", which is described further on my justice network blog.

A HECM does not require a homeowner to make mortgage payments as a conventional mortgage does. Instead, a HECM does not become due and payable until the last surviving homeowner dies or no longer lives in the home. 12 U.S.C. § 1715-z20(j) Safeguard to prevent displacement of homeowner. The HECM becomes due and payable in full "if a mortgagor dies and the property is not the principal residence of at least one surviving mortgagor....and no other mortgagor retains title to the property." 24 C.F.R. § 206.27(c).

I am one of two surviving HECM mortgagors, and the only surviving homeowner living in the home, alone, in substantial compliance with the HECM Note, making this foreclosure of a HECM premature. My bother Mark Gillespie of Fort Worth Texas is also a surviving borrower, but he does not live in the home. The HECM becomes due and payable in full "if a mortgagor dies and the property is not the principal residence of at least one surviving mortgagor....and no other mortgagor retains title to the property." 24 C.F.R. § 206.27(c). Mortgagor Ms. Gillespie died in 2009.

But I am a surviving borrower or mortgagor living in the home as my principal residence, and retain title to the property. Therefore I dispute the Plaintiff's allegations in its "Verified Complaint to Foreclose Home Equity Conversion Mortgage". (Doc. 2). That means a substantial disputed issue of federal HECM law is a necessary element of the Plaintiff's state law foreclosure claim that this HECM is due and payable.

The district court has subject matter jurisdiction under 28 U.S.C. § 1331 and the U.S. Constitution, Article III, Section 2 for "all cases, in law and equity, arising under this Constitution, [and] the laws of the United States...". (Doc. 18, page 2). Fed. R. Civ. Pro 13(g) permits a crossclaim by one party, me, against a coparty, HUD, "if the claim arises out of the transaction or occurrence that is the subject matter of the original action or of a counterclaim, or if the claim relates to any property that is the subject matter of the original action." My home is property that is the subject matter of the original action. The Plaintiff's Complaint (Doc. 2) is an in rem action against my home (Doc. 1, 1, and 15) my primary residence (Doc. 5, 2, 6, 9, 20, 118, ) and homestead. (Doc. 9).

Also see my Motion to Reconsider, Vacate or Modify Order filed July 2, 2013 in the U.S. Eleventh Circuit Court of Appeals, No. 13-11585-B. Most of the pleadings are posted on Scribd, including my Notice of Removal, the foreclosure complaint, my motion to dismiss,and exhibits, with my complaint to the Consumer Financial Protection Bureau (CFPB), parts one, two and three.

Thank you for your support.

Neil J. Gillespie

8092 SW 115th Loop

Ocala, Florida 34481

[fn1] I was a client of Community Legal Services of Mid-Fla. which provides legal advice, but not foreclosure representation. I paid a $25 Florida Bar referral fee to Gregory D. Jones, Esq. but he has not responded to my disability accommodation request, or consulted with me on UPL.

[fn2] I am one of three (3) HECM borrowers, with brother Mark Gillespie, and mother Penelope Gillespie, whose death September 16, 2009 Plaintiff claims is grounds to accelerate the debt.

[fn3] Reverse Mortgage Solutions, Inc. v. Neil J. Gillespie, et al., Marion County Florida, Fifth Judicial Circuit, No. 42-2013CA-000115-AXXX-XX; removed February 4, 2013 to U.S. District Court, Ocala Division, Middle District Florida, No. 5:13-cv-00058-WTH-PRL; U.S. Court of Appeals for the Eleventh Circuit, No. 13-11585-B; real party Plaintiff, Bank of America, N.A.

[fn4] 12 U.S.C. § 1715z"“20 - Insurance of home equity conversion mortgages for elderly homeowners, and 24 C.F.R. Part 206, Home Equity Conversion Mortgage Insurance.

[fn5] The Federal Housing Administration (FHA) is a United States government agency.

Organizer

Neil Gillespie

Organizer

Ocala, FL