Pay$50K Tax Agent Demand or 2-5 Yrs

Donation protected

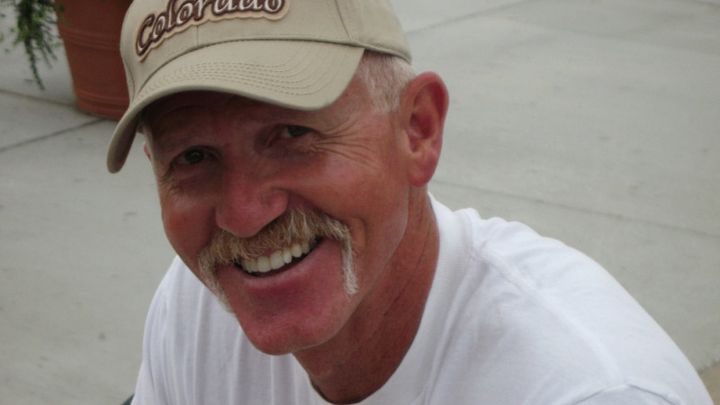

This is me, Daryl Giesking. I am a 68-year old husband, father, and grandfather who lived and worked most of my life in Texas and Colorado. I have three adult sons and three grandchildren.

My wife of many years and I found ourselves truly unable to resolve our mounting differences, so after many years and three sons together, we divorced. I stayed in Colorado close to our sons who were approaching adulthood. After retiring as a geophysicist, I opened a small delicatessen where I worked alongside my sons. Although this new endeavor sustained us, my income was substantially less.

In 2008 I hired an Enrolled IRS Agent to prepare my 2007 taxes.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

***Definition: An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee. Enrolled agent status is the highest credential the IRS awards. Individuals who obtain this elite status must adhere to ethical standards and complete 72 hours of continuing education courses every three years.

Enrolled agents, like attorneys and certified public accountants (CPAs), have unlimited practice rights. This means they are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and which IRS offices they can represent clients before.

https://www.irs.gov/tax-professionals/enrolled-agents/enrolled-agent-information

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

The Enrolled IRS Tax Agent I hired to prepare my 2007 taxes, recommended a “new to me” 1099 tax form. I took their recommendation. My taxes were then completed and filed by the Enrolled Agent. Four months later, after an IRS review, I received a $300,000 refund.

I felt that this legal IRS refund was a blessing for which I was extremely grateful. After the 2008 stock market crash, my delicatessen business dwindled. Despite my simple lifestyle, my personal net worth was now in the negative. After receiving this refund, my first action was to donate more than 10% to charities (as a tithe) and my second action was to spend a sizeable portion for the medical needs of one of my sons. I then paid existing bills and carefully invested the remaining funds.

I felt truly blessed by this refund for two reasons: My financial worries had been relieved and I was able to pay my son's medical bills. I also met an incredible woman, Nancy, who became my soul mate and wife. Together we explored how we might live more comfortably through our golden years. Partly due to the 2008 economic recession in Colorado and elsewhere in the USA, we felt we should look into other more sustainable, economically viable locations. Though we remain loyal Americans, my wife and I, along with tens of thousands of other baby boomers, learned that Ecuador was a very affordable place to live where organic food is grown year round. We started making plans to move.

Apparently, the IRS was and is displeased with this particular 1099 tax form tax filing process that their agents promote - a legal 1099 tax form filed by many Americans every year. Does this make sense to you?

While still living in Colorado in February 2009, I received the first of several letters from the IRS. This was four months after the IRS had issued me a refund, which was based on IRS printed forms, IRS laws, prepared by their approved tax preparers, and then approved through the IRS review process.

These letters threatened me with garnishments and liens if I did not return all the funds they had refunded to me from my 2007 taxes. I wrote back each time I received a letter explaining that I was not aware of having done anything inappropriate. I asked them to clarify which, if any, law(s) I had broken. I clearly stated in each letter that I would cooperate fully with them. Even though I stayed in contact with the IRS, not once did I receive a response to my inquiries from them or any other branch of the government.

Remember, that an Enrolled IRS Agent/Certified Public Accountant had advised me of this 1099 form and prepared my taxes, so I was completely unaware that I had broken any law.

So assuming the IRS had sent these letters to me in error, and sure that I had done nothing inappropriate or illegal, my wife and I continued with our plans and moved to Ecuador in June 2009. It took us some time to locate the exact piece of land we wanted. We searched for the right area that would be most suitable for us to raise our vegetables, enjoy our dogs, and live off the grid. After exploring various places in the country, in 2013 we purchased a small one-acre parcel of land where we would live sustainably.

We had heard nothing from the IRS or any other branch of the US government from 2009 - June 2016. We were in the process of building our home on this small parcel of land when in the early morning hours of June 23, 2016, our lives were turned upside down.

After a typical day of building and living off the land, we had fallen asleep in the quiet countryside. At 3 a.m., armed masked Ecuadorian police – along with USA State Department agents – cut the locks, raided our home and arrested me, stating that I was to be deported. Nancy and I were taken into custody. We were both very frightened and confused regarding the "deportation" order. The US Government had revoked my passport and instructed the Ecuadorian Government to cancel my visa. The Ecuadorian court issued a ruling that allowed a specifically assigned US representative to take me into custody and deport me back to the U.S.

After several days awaiting deportation in Quito, I was flown back to the USA and immediately jailed for three weeks in Colorado. I understand now that I was denied my Miranda rights and that no arrest warrant had actually been issued or filed for me to be held in jail.

Nancy, frantically working from Ecuador made many inquiries regarding my deportation and the charges against me, while I was and am still working from Denver. We found that in 2013 (previously unbeknownst to either of us) that the IRS had raided the Enrolled Agent's office in California. They found my name (and I presume names of others) on her computer/files. The IRS then proceeded to issue an indictment for me along with a warrant for my arrest. Again, I had been completely in the dark regarding these events and charges until my arrest on June 23, 2016 at 3:00 a.m. in my home in Ecuador.

What still remains confusing to me is that Enrolled IRS Agents are the most respected, most trained, ethical people from which an individual can seek tax advice. If this is the case, why are Enrolled IRS Agents / tax preparers trained to advise their clients that this 1099 form for filing taxes is legal, and then later their clients' lives are torn apart? As we found out later, many other individuals are now going through (or have gone through) similar traumatic and life-disrupting events as I am experiencing.

I have been charged with "conspiracy to commit fraud." I have never been in trouble with the law in my entire life. In my opinion, the only crime of which I'm guilty was trusting the Enrolled IRS Agent I hired in 2008.

I have informed the IRS that I can arrange to make payments of restitution related to their tax refund for my 2007 taxes, but I do not have funds for a lump-sum payment. I cannot explain why this money must be paid in full to avoid jail, but they are asking the $50,000 which must be paid by May 2017. If not, the court-appointed lawyer in Denver has told me that I could spend 2-5 years in jail. This lawyer also tells me that if I can pay the government $50,000 prior to May 2017, I may be able to avoid the court hearing and will not be sent to jail.

I am currently under GPS house confinement living with my son in Denver, Colorado and awaiting trial in May 2017. Today it is January 16, 2017. I have been away from my wife and home for more than seven months.

I have less than three months in which to raise the funds needed to submit a plea to prevent this trial and a 2-5 year jail sentence.

Nancy and I are unpretentious and live very simply. We are devout people. We observe the Sabbath, serve others, and do no harm. We are vegetarian and law-abiding. Except for my social security, we have no other income and no remaining savings. We have paid more than $25,000 in legal fees incurred both in Ecuador and here in the USA since June 2016, so the small amount of money we had in an Ecuadorian savings account has now been depleted.

My wife and I are desperately trying to raise the $50,000. Nancy is growing organic vegetables, selling baked goods, trying to sell our second-hand vehicle, used motorcycle, furniture, and liquidating everything we have that might help us raise some funds, but so far we have met with no success.

Nancy is living alone on our isolated property. She's doing her best but is still challenged to take care of the animals, tend the gardens, and do all the upkeep by herself. She needs her husband home.

We are now seeking your help to raise money to pay the government's plea agreement – for a crime that I didn't commit. I pray that with your help I can raise the $50,000 to prevent my possible jail time. Hopefully, I will be permitted to return to my wife and home to live in peace.

It is with deep humility and appreciation that I ask for your assistance in resolving this matter. I pray that you may be able to help me with a small donation. Anything will help.

May our Creator have favor on you,

Daryl Giesking

These funds, if raised will not be used for anything other than to pay the amount the government is demanding.

Organizer

Daryl Giesking

Organizer

Denver, CO