Help Escaping Student Loans

I hate that I’m doing this. I hate that I have to do this. But after a lifetime of being told I was too headstrong and stubborn to get help when I needed it, combined with personal events this year that called my independent nature into question, maybe it’s time for a little humility as a growth experience.

I need help with my student loans.

I wasn’t even supposed to be in a doctoral program—at least if my 8th grade guidance counselor had his way, I wouldn’t have been there. “You’re not college material” was what he said…which was a polite way of saying “you’re too dumb for college.” At thirteen, I set out to prove him wrong. Spiting one person became my goal in life—not only getting into college, but going as high as I could…just to prove to myself that I wasn’t stupid. Because I was tracked out of the college prep track as a public school student, I made it my goal in life to go beyond my peers. But I had to fight my way up to the doctoral level. First, I had to get through high school. I then had to get into an undergraduate program and graduate from it. Both were uphill climbs. I had to juggle my studies with multiple jobs. I had to grapple with then-undiagnosed learning disabilities. Despite them all, I walked with my BA in English in August 1994.

By the time I graduated, I decided to become an educator by trade. I saw how destructive one administrator could be, and I entered teaching as a profession to champion the “too dumb” students whom others had discarded. With that career in mind, I started graduate school—and walked with my MA in English in 2003. It took me seven years. I graduated the last semester before my credits would have begun to expire. While I was in graduate school, I began teaching and found my career footing. I was good at it—even if I was unconventional at times. Upon learning that public school teachers needed academic training, I went back to graduate school for training in curriculum and instruction and settled into the public school sector.

It was pursuing that second degree that professors started to suggest I pursue a doctorate. I pushed myself to brace for the GRE. I worked with professors on recommendations. I researched and focused on a proposed area of study. I jumped through the hoops of interviews. And in early 2005, I was admitted to the Ed. D. program at a Florida university (whose lawyers far outnumber mine, so I’d rather not name them). Again, I struggled, but I knew I would. I wasn’t bred or raised for college like my peers. I was the dumb kid from Flint, Michigan who wouldn’t take “no” for an answer in 1985.

In late 2006, I lost my public school teaching job. By then, I was several semesters into my doctorate. At that point in time, I knew I was committed to the degree. While making a partial living as a college adjunct at several community colleges, I began to take out student loans to keep myself fed and sheltered and cover school expenses. I still pushed on—through the classes, past the comprehensive exams, and onto the qualifying exams in mid-2009.

When the Great Recession hit state budgets in early 2009, adjuncts were the first to go, as teaching schedules were cut. My contracts dried up. I hung on as long as I could to enter candidacy in my doctorate. As soon as I was at the dissertation phase, I relocated to North Carolina. A friend (later my husband) knew I’d fallen on hard times and offered not only job prospects (that fell through once I arrived) but a place to stay.

I made what I’ve come to call poor life choices for my dissertation committee members. I told my chair in mid-2009 that I had to relocate from Florida to North Carolina (since the university would not provide me with graduate teaching/research work, as I was a higher ed and not K-12 researcher), and his initial response was “we got you this far, and now you’re dropping out?” I asked to work on my dissertation from a distance, as I couldn’t afford to live in Florida, and I was nearing the cap of my student loans. In 2009 “distance education” meant that most instructors had little to no contact with students—especially on unstructured projects like dissertations. I had members like Professor About-To-Retire (“I don’t care. I defer to the Committee”), Professor Newly-Minted-Ph.D. (“I don’t care. I defer to the Committee”), and Professor Just-Here-To-Fill-The-Roster-Out (“I don’t care. I defer to the Committee”), all with my rather bitter chair at the lead. It took two years of emails back and forth, with long delays between them, to finally get a prospectus approved. By then, there just wasn’t time to finish and defend the dissertation. My credits started to expire off. I washed out ABD—All But Dissertation.

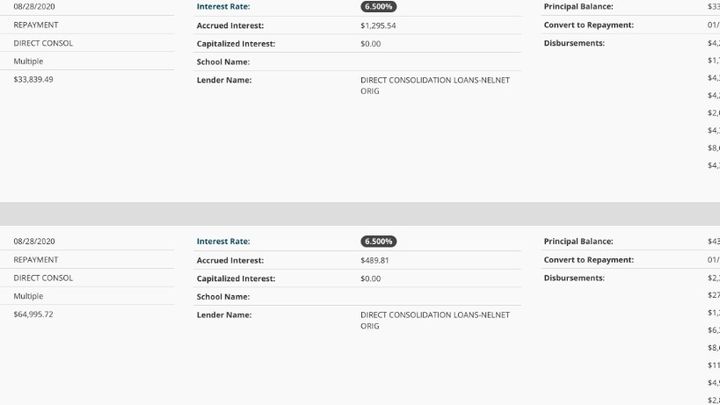

But the loans hung out there, building interest over the years. When I landed my current job in 2015, I first paid down the credit card debt that accumulated during the Great Recession, then I turned my attention to my student loans—whose interest had ballooned to nearly six figures.

After consolidating my loans, I reached out to family for help. My father was destitute and living on a meager Social Security check. My brother quickly changed the topic. My mother told me to simply treat my loans like a mortgage…that I would one day pay off.

Meanwhile, I live in a state of constant exhaustion. I not only work my academic job, but I have a side hustle at a local pizza place, making $9 an hour. When my monthly bills are paid off, everything goes to Nelnet. I’ve taken to falling asleep in random places because I just don’t have the energy to keep going. A coffee pot keeps me going on my day job, and caffeine pills keep me going on the weekend job. I’m in a perpetual state of anxiety because I know I have the student loans constantly closing in on me, and I can’t stop working—even to just take a day off from the pizza place. I’m in constant pain from working two jobs. I’m using alcohol more frequently to take the edge off when I get home from my jobs. I’m using narcotic painkillers more and more frequently to ensure I sleep without pain interfering with what rest I can get. I have nightmares about losing my job and becoming consumed by the loans. I’ve not had anything looking like a vacation (read: time away from Raleigh when I can just sit, rest, and do nothing) since 2017—when I took a road trip home to visit my Michigan family. I don’t plan on taking a vacation until my student loans are paid off. I can’t justify spending money on myself when I can push it towards Nelnet.

I’m asking for help. Yes, I got myself into this thirteen years ago. This is all my fault, and I take full responsibility for it. I'm not blaming anyone for my loans but me. I should have considered a retreat back home to Michigan instead of taking out the student loans in 2006. But sometimes you just get focused on a goal that’s so close that it feels like you’re doing the right thing---even if hindsight proves you were wrong. It’s like that message that Tony Stark creates for Pepper Potts at the opening of Avengers Endgame—about somehow pulling out one last trick to save the day…but falling short. I took the loans out in hopes that they could coast me through the doctorate. When my adjunct gigs fell through, and I had to leave the state, I tried to put together a dissertation committee to help me complete it from a distance.

…unfortunately, the members of my dissertation committee didn’t have the same drive to student success that I bring to my students. So I’m now trying to pull out of the wreckage of student loans—just trying to get back to a point where I don’t have the constant anxiety looming over me.

I need help with my student loans.

I wasn’t even supposed to be in a doctoral program—at least if my 8th grade guidance counselor had his way, I wouldn’t have been there. “You’re not college material” was what he said…which was a polite way of saying “you’re too dumb for college.” At thirteen, I set out to prove him wrong. Spiting one person became my goal in life—not only getting into college, but going as high as I could…just to prove to myself that I wasn’t stupid. Because I was tracked out of the college prep track as a public school student, I made it my goal in life to go beyond my peers. But I had to fight my way up to the doctoral level. First, I had to get through high school. I then had to get into an undergraduate program and graduate from it. Both were uphill climbs. I had to juggle my studies with multiple jobs. I had to grapple with then-undiagnosed learning disabilities. Despite them all, I walked with my BA in English in August 1994.

By the time I graduated, I decided to become an educator by trade. I saw how destructive one administrator could be, and I entered teaching as a profession to champion the “too dumb” students whom others had discarded. With that career in mind, I started graduate school—and walked with my MA in English in 2003. It took me seven years. I graduated the last semester before my credits would have begun to expire. While I was in graduate school, I began teaching and found my career footing. I was good at it—even if I was unconventional at times. Upon learning that public school teachers needed academic training, I went back to graduate school for training in curriculum and instruction and settled into the public school sector.

It was pursuing that second degree that professors started to suggest I pursue a doctorate. I pushed myself to brace for the GRE. I worked with professors on recommendations. I researched and focused on a proposed area of study. I jumped through the hoops of interviews. And in early 2005, I was admitted to the Ed. D. program at a Florida university (whose lawyers far outnumber mine, so I’d rather not name them). Again, I struggled, but I knew I would. I wasn’t bred or raised for college like my peers. I was the dumb kid from Flint, Michigan who wouldn’t take “no” for an answer in 1985.

In late 2006, I lost my public school teaching job. By then, I was several semesters into my doctorate. At that point in time, I knew I was committed to the degree. While making a partial living as a college adjunct at several community colleges, I began to take out student loans to keep myself fed and sheltered and cover school expenses. I still pushed on—through the classes, past the comprehensive exams, and onto the qualifying exams in mid-2009.

When the Great Recession hit state budgets in early 2009, adjuncts were the first to go, as teaching schedules were cut. My contracts dried up. I hung on as long as I could to enter candidacy in my doctorate. As soon as I was at the dissertation phase, I relocated to North Carolina. A friend (later my husband) knew I’d fallen on hard times and offered not only job prospects (that fell through once I arrived) but a place to stay.

I made what I’ve come to call poor life choices for my dissertation committee members. I told my chair in mid-2009 that I had to relocate from Florida to North Carolina (since the university would not provide me with graduate teaching/research work, as I was a higher ed and not K-12 researcher), and his initial response was “we got you this far, and now you’re dropping out?” I asked to work on my dissertation from a distance, as I couldn’t afford to live in Florida, and I was nearing the cap of my student loans. In 2009 “distance education” meant that most instructors had little to no contact with students—especially on unstructured projects like dissertations. I had members like Professor About-To-Retire (“I don’t care. I defer to the Committee”), Professor Newly-Minted-Ph.D. (“I don’t care. I defer to the Committee”), and Professor Just-Here-To-Fill-The-Roster-Out (“I don’t care. I defer to the Committee”), all with my rather bitter chair at the lead. It took two years of emails back and forth, with long delays between them, to finally get a prospectus approved. By then, there just wasn’t time to finish and defend the dissertation. My credits started to expire off. I washed out ABD—All But Dissertation.

But the loans hung out there, building interest over the years. When I landed my current job in 2015, I first paid down the credit card debt that accumulated during the Great Recession, then I turned my attention to my student loans—whose interest had ballooned to nearly six figures.

After consolidating my loans, I reached out to family for help. My father was destitute and living on a meager Social Security check. My brother quickly changed the topic. My mother told me to simply treat my loans like a mortgage…that I would one day pay off.

Meanwhile, I live in a state of constant exhaustion. I not only work my academic job, but I have a side hustle at a local pizza place, making $9 an hour. When my monthly bills are paid off, everything goes to Nelnet. I’ve taken to falling asleep in random places because I just don’t have the energy to keep going. A coffee pot keeps me going on my day job, and caffeine pills keep me going on the weekend job. I’m in a perpetual state of anxiety because I know I have the student loans constantly closing in on me, and I can’t stop working—even to just take a day off from the pizza place. I’m in constant pain from working two jobs. I’m using alcohol more frequently to take the edge off when I get home from my jobs. I’m using narcotic painkillers more and more frequently to ensure I sleep without pain interfering with what rest I can get. I have nightmares about losing my job and becoming consumed by the loans. I’ve not had anything looking like a vacation (read: time away from Raleigh when I can just sit, rest, and do nothing) since 2017—when I took a road trip home to visit my Michigan family. I don’t plan on taking a vacation until my student loans are paid off. I can’t justify spending money on myself when I can push it towards Nelnet.

I’m asking for help. Yes, I got myself into this thirteen years ago. This is all my fault, and I take full responsibility for it. I'm not blaming anyone for my loans but me. I should have considered a retreat back home to Michigan instead of taking out the student loans in 2006. But sometimes you just get focused on a goal that’s so close that it feels like you’re doing the right thing---even if hindsight proves you were wrong. It’s like that message that Tony Stark creates for Pepper Potts at the opening of Avengers Endgame—about somehow pulling out one last trick to save the day…but falling short. I took the loans out in hopes that they could coast me through the doctorate. When my adjunct gigs fell through, and I had to leave the state, I tried to put together a dissertation committee to help me complete it from a distance.

…unfortunately, the members of my dissertation committee didn’t have the same drive to student success that I bring to my students. So I’m now trying to pull out of the wreckage of student loans—just trying to get back to a point where I don’t have the constant anxiety looming over me.

Organizer

Matthew Henry

Organizer

Cary, NC