K Belez

Donation protected

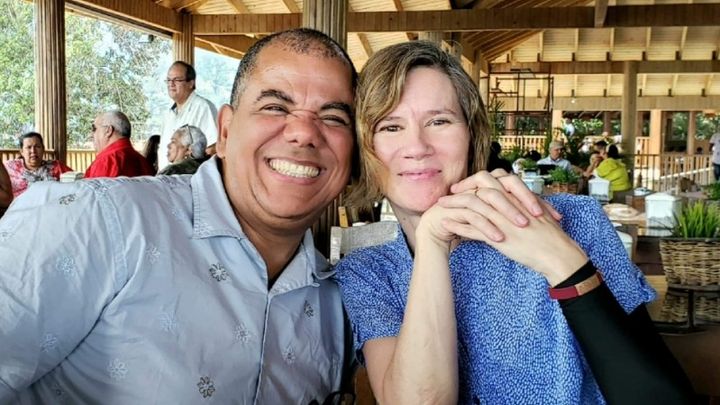

From Kimberley:

My husband and I serve in the Dominican Republic with a national organization called Sinergia, (Sinergy Leadership Foundation), which focuses on grassroots leadership development in schools, churches, and communities. We work to identify natural leaders to come alongside, mentor, offer training opportunities, etc. Our goal is to equip the people who live here, as they know their communities and environments better than we ever can.

Serving in a developing nation does entail some sacrifices, one of which is access to good medical insurance plans. Both of us have been blessed with good health, and I have had annual mammograms since age 36. It was a shock to discover a small lump short weeks after arriving in the Dominican Republic in January 2019. We sought medical care there, and were relieved to learn it was a noncancerous

mass.

In November 2019, before returning to the Dominican Republic after spending some months in the United States and Canada to connect with supporters, family, etc., I had a mammogram. After additional testing, I was told that I had breast cancer. This was devastating news, particularly because my mother had battled breast cancer when I was 10 and again when I was 27. The second cancer metastasized, and she died at age 59.

Thankfully, my cancer was determined to be Stage 1, and after a lumpectomy, radiation, (and a six month wait due to the COVID-19 pandemic), I was able to rejoin my husband and our work in the Dominican Republic mid-July 2020.

Throughout this time, I have been communicating back and forth with our insurance, providing documents, and clarifying what had happened. Mid-August, I received official notice that my breast cancer claim was denied. International medical plans do not have to abide by US laws. The reason given is that I discovered the lump within the first 180-days of our coverage. Even though at that time I was told it was benign our insurance determined that it was a ‘condition of the breast’ which excluded it. This means that all diagnostics, surgery, appointments, treatments, current and future, will not be covered.

I have contacted the various medical practices and received some ‘self-pay’ discounts, bringing the total from $80,000 down to approximately $56,000. I also anticipate approximately $1,500-$2,000 annually in the next 5 years for follow up appointments and diagnostics.

My husband and I serve in the Dominican Republic with a national organization called Sinergia, (Sinergy Leadership Foundation), which focuses on grassroots leadership development in schools, churches, and communities. We work to identify natural leaders to come alongside, mentor, offer training opportunities, etc. Our goal is to equip the people who live here, as they know their communities and environments better than we ever can.

Serving in a developing nation does entail some sacrifices, one of which is access to good medical insurance plans. Both of us have been blessed with good health, and I have had annual mammograms since age 36. It was a shock to discover a small lump short weeks after arriving in the Dominican Republic in January 2019. We sought medical care there, and were relieved to learn it was a noncancerous

mass.

In November 2019, before returning to the Dominican Republic after spending some months in the United States and Canada to connect with supporters, family, etc., I had a mammogram. After additional testing, I was told that I had breast cancer. This was devastating news, particularly because my mother had battled breast cancer when I was 10 and again when I was 27. The second cancer metastasized, and she died at age 59.

Thankfully, my cancer was determined to be Stage 1, and after a lumpectomy, radiation, (and a six month wait due to the COVID-19 pandemic), I was able to rejoin my husband and our work in the Dominican Republic mid-July 2020.

Throughout this time, I have been communicating back and forth with our insurance, providing documents, and clarifying what had happened. Mid-August, I received official notice that my breast cancer claim was denied. International medical plans do not have to abide by US laws. The reason given is that I discovered the lump within the first 180-days of our coverage. Even though at that time I was told it was benign our insurance determined that it was a ‘condition of the breast’ which excluded it. This means that all diagnostics, surgery, appointments, treatments, current and future, will not be covered.

I have contacted the various medical practices and received some ‘self-pay’ discounts, bringing the total from $80,000 down to approximately $56,000. I also anticipate approximately $1,500-$2,000 annually in the next 5 years for follow up appointments and diagnostics.

Organizer and beneficiary

Ellen Jeltema

Organizer

Grand Rapids, MI

Kimberley Joy Belez

Beneficiary