Help My Neighbor Keep his Home

Donation protected

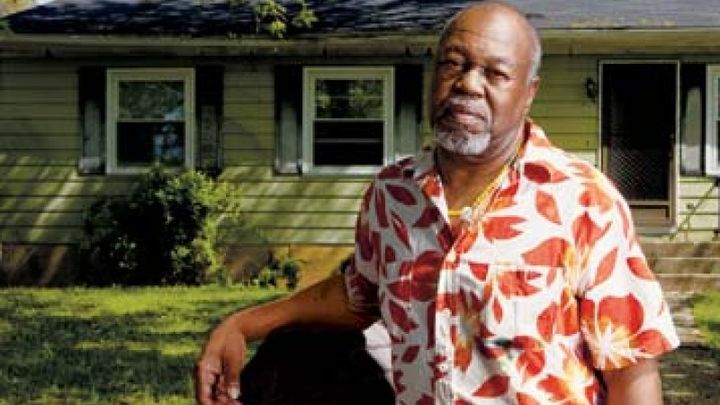

Robert Bennett is a 72 year old retired Naval Academy cook in Annapolis, MD. Mr. Bennett and his wife Ophelia owned their home jointly from 1981 to 2008. In late 2008, they were contacted by a mortgage broker selling reverse mortgages and promising that this loan would allow them to continue to live in their home, with no payments, for the rest of their lives. Mrs. Bennett, 10 years older than her husband, had suffered a stroke recently, so finances were tight and they thought this sounded like a good idea.

In December 2008, a reverse mortgage was taken out. Mr. Bennett unknowingly signed a document which gave up all of his interest in the property to his wife, the only borrower. The amount that can be drawn from a reverse mortgage is based on the value of the home and the age of the youngest borrower. While removing Mr. Bennett from the deed meant a larger loan amount, it also meant that Mr. Bennett would lose the home if his wife died first. The Bennetts knew nothing about any of this. But the consequences were right around the corner.

Mrs. Bennett died one month later and the loan came due and payable immediately. Believing he would lose his home, Mr. Bennett stopped paying the taxes on the property.

In 2011, the AARP Foundation helped Mr. Bennett and two other surviving spouses file a lawsuit against the U.S. Dept. of Housing and Urban Development, that runs the federal reverse mortgage program. In 2013, they won an important victory. The court found that HUD had not protected the spouses from being displaced from their homes. HUD permitted Mr. Bennett to remain in his home. But HUD has insisted that he repay the taxes that were advanced on his behalf before it will do so. Mr. Bennett currently owes about $9,000 to the servicer of his mortgage for unpaid taxes. If these funds are not repaid within the next 30 days, he will lose his home. Mr. Bennett has no savings, but he has sufficient retirement income to keep current on his taxes going forward.

Can you please help Mr. Bennett remain in his home? Every donation of ANY amount will be deeply appreciated

In December 2008, a reverse mortgage was taken out. Mr. Bennett unknowingly signed a document which gave up all of his interest in the property to his wife, the only borrower. The amount that can be drawn from a reverse mortgage is based on the value of the home and the age of the youngest borrower. While removing Mr. Bennett from the deed meant a larger loan amount, it also meant that Mr. Bennett would lose the home if his wife died first. The Bennetts knew nothing about any of this. But the consequences were right around the corner.

Mrs. Bennett died one month later and the loan came due and payable immediately. Believing he would lose his home, Mr. Bennett stopped paying the taxes on the property.

In 2011, the AARP Foundation helped Mr. Bennett and two other surviving spouses file a lawsuit against the U.S. Dept. of Housing and Urban Development, that runs the federal reverse mortgage program. In 2013, they won an important victory. The court found that HUD had not protected the spouses from being displaced from their homes. HUD permitted Mr. Bennett to remain in his home. But HUD has insisted that he repay the taxes that were advanced on his behalf before it will do so. Mr. Bennett currently owes about $9,000 to the servicer of his mortgage for unpaid taxes. If these funds are not repaid within the next 30 days, he will lose his home. Mr. Bennett has no savings, but he has sufficient retirement income to keep current on his taxes going forward.

Can you please help Mr. Bennett remain in his home? Every donation of ANY amount will be deeply appreciated

Organizer

Bronwyn Belling

Organizer

Annapolis, MD