Uptowner has recently been designated Wisconsin's oldest tavern but its future is in jeopardy.

Save Uptowner is more than just our story. It is the story of all the home owners and small business owners who lost their places through no fault of their own.

Our story began 130 years ago and…… That’s a Lotta Beer!

Riverwest Neighborhood, Milwaukee, —The year was 1884, and Grover Cleveland had just been elected the 25th President of the 38 United States of America. Milwaukee was the country's 17th largest city with nearly 140,000 residents. John L. Sullivan was the heavyweight boxing champion of the world. Mark Twain, Louisa May Alcott and Walt Whitman were the

nation's bestselling authors. Other famous celebrities included showman P.T Barnum and his diminutive 3’4” star Tom Thumb; William "Buffalo Bill" Cody sold out venues across the country with his popular "Wild West Show" featuring sharpshooter Annie Oakley. The whole

nation knew the melodies and lyrics of Stephen Foster’s songs and the marches of John Philip Sousa while Scott Joplin was popularizing a brand new musical genre called "Ragtime".

And, on the NW corner of Center Street and Humboldt Boulevard an enterprising publican opened his own tavern, eponymously called The Barnet Kozlowski Saloon. The new enterprise was so successful that in 1891 the Schlitz Brewing Company contracted with Kozlowski to operate his popular watering hole as a "Tied House" selling only “The Beer that Made Milwaukee Famous."

Even during Prohibition, the establishment prospered under new owners as the Gordon Park Pharmacy where —for the right price and perhaps a secret password — determined patrons could procure "medicinal beverages."

From the end of Prohibition through the early 1950s , the corner tavern went through several owners and name changes till a transplanted New Yorker named Chic Giacalone purchased the property in 1952 and re-named it the Uptowner.

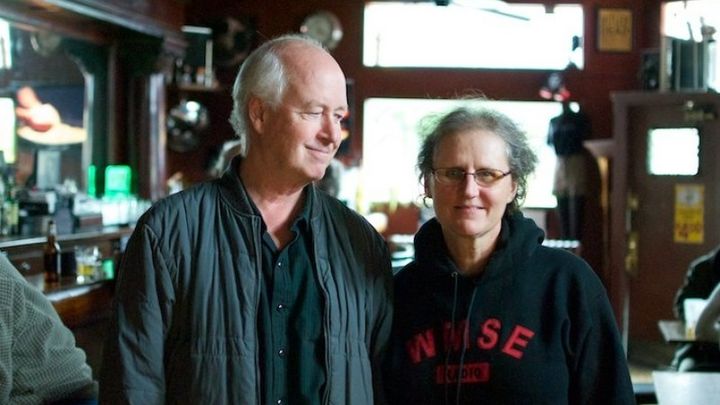

Then in 1985, Steve Johnson, purchased the Uptowner from Chic and under his shrewd, if somewhat unorthodox managerial style, it still flourishes today as one of Milwaukee's last original Schlitz "Tied Houses" and Wisconsin's oldest continuously operating purveyor of adult beverages......

...... Except not for much longer if something cannot be worked out with Seaway Bank of Chicago.

Why?

Back in 2006, Stephen Johnson used equity in the Uptowner building to procure a line of credit with Legacy Bank of Milwaukee to invest in the redevelopment of three other properties in the community via Federal government-backed economic development loans.

Over the next six years, Steve faithfully made made his monthly mortgage payments and worked on refurbishing the properties, two of which were completely empty and boarded up when he began.

Then, in 2011, Legacy Bank failed like so many banks due to the global recession. An out of state bank from Chicago took over its assets for pennies on the dollar in a deal subsidized by the FDIC.

Meanwhile, Steve found it increasingly difficult to pay the mortgages in full under the terms and conditions agreed upon in 2006 and maintain and improve the properties at the same time. He tried to negotiate loan modifications to no avail since 2010. The Bank has consistently refused to negotiate and have instead called in the loans in full.

After years of failed attempts to achieve a win-win settlement with the Bank, time is now short. Foreclosure proceedings are underway and the buildings may be sold early to mid summer.

Funds are needed for legal fees and to pay down debt if a settlement can still be negotiated to SAVE UPTOWNER.

Investors seeking a return are also welcome. Email us to discuss. Thank you in advance!

Save Uptowner is more than just our story. It is the story of all the home owners and small business owners who lost their places through no fault of their own.

Our story began 130 years ago and…… That’s a Lotta Beer!

Riverwest Neighborhood, Milwaukee, —The year was 1884, and Grover Cleveland had just been elected the 25th President of the 38 United States of America. Milwaukee was the country's 17th largest city with nearly 140,000 residents. John L. Sullivan was the heavyweight boxing champion of the world. Mark Twain, Louisa May Alcott and Walt Whitman were the

nation's bestselling authors. Other famous celebrities included showman P.T Barnum and his diminutive 3’4” star Tom Thumb; William "Buffalo Bill" Cody sold out venues across the country with his popular "Wild West Show" featuring sharpshooter Annie Oakley. The whole

nation knew the melodies and lyrics of Stephen Foster’s songs and the marches of John Philip Sousa while Scott Joplin was popularizing a brand new musical genre called "Ragtime".

And, on the NW corner of Center Street and Humboldt Boulevard an enterprising publican opened his own tavern, eponymously called The Barnet Kozlowski Saloon. The new enterprise was so successful that in 1891 the Schlitz Brewing Company contracted with Kozlowski to operate his popular watering hole as a "Tied House" selling only “The Beer that Made Milwaukee Famous."

Even during Prohibition, the establishment prospered under new owners as the Gordon Park Pharmacy where —for the right price and perhaps a secret password — determined patrons could procure "medicinal beverages."

From the end of Prohibition through the early 1950s , the corner tavern went through several owners and name changes till a transplanted New Yorker named Chic Giacalone purchased the property in 1952 and re-named it the Uptowner.

Then in 1985, Steve Johnson, purchased the Uptowner from Chic and under his shrewd, if somewhat unorthodox managerial style, it still flourishes today as one of Milwaukee's last original Schlitz "Tied Houses" and Wisconsin's oldest continuously operating purveyor of adult beverages......

...... Except not for much longer if something cannot be worked out with Seaway Bank of Chicago.

Why?

Back in 2006, Stephen Johnson used equity in the Uptowner building to procure a line of credit with Legacy Bank of Milwaukee to invest in the redevelopment of three other properties in the community via Federal government-backed economic development loans.

Over the next six years, Steve faithfully made made his monthly mortgage payments and worked on refurbishing the properties, two of which were completely empty and boarded up when he began.

Then, in 2011, Legacy Bank failed like so many banks due to the global recession. An out of state bank from Chicago took over its assets for pennies on the dollar in a deal subsidized by the FDIC.

Meanwhile, Steve found it increasingly difficult to pay the mortgages in full under the terms and conditions agreed upon in 2006 and maintain and improve the properties at the same time. He tried to negotiate loan modifications to no avail since 2010. The Bank has consistently refused to negotiate and have instead called in the loans in full.

After years of failed attempts to achieve a win-win settlement with the Bank, time is now short. Foreclosure proceedings are underway and the buildings may be sold early to mid summer.

Funds are needed for legal fees and to pay down debt if a settlement can still be negotiated to SAVE UPTOWNER.

Investors seeking a return are also welcome. Email us to discuss. Thank you in advance!